Silver Shines Bright: The Unprecedented Surge and Its Driving Forces

– Authored by Mudit Singhania, Senior Partner and Head – Commodities, Alpha Alternatives

Tuesday, 04 June 2024

Silver has witnessed the strongest start to a calendar year since 2011, gaining about 30% in the first five months of 2024. Domestic silver prices have surged to record highs above ₹90,000 per kilogram. This significant move is remarkable, considering silver had been consolidating within a wide range for the past

several years. The rally is driven by improving fundamentals, as robust demand continues to outweigh supply, resulting in a structural deficit for the last three consecutive years.

Silver Demand on the Rise

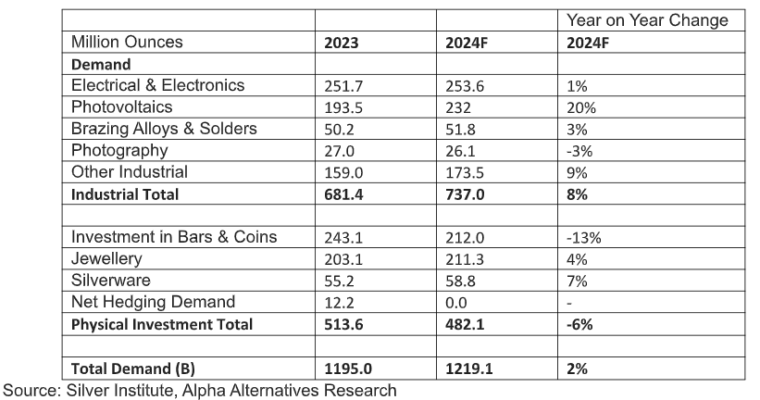

Silver is traditionally known for its use in jewellery, silverware, and coinage. However, industrial demand now dominates the silver market, accounting for more than 50% of silver usage. Due to its unique electrical properties, silver is widely used in electronics, solar panels, photography, and more. Increasing

use of silver in green energy initiatives is causing a substantial rise in industrial demand for the metal. In 2023, industrial demand for silver grew strongly by about 11% to a record 681.4 million ounces and is expected to hit another record high this year, rising 8% to 737 million ounces. This surge is primarily driven by a 20% year-on-year increase in silver demand for photovoltaic (PV) solar panels, projected to reach 232 million ounces.

Jewellery fabrication is another crucial pillar of strength for silver, which is likely to see consistent growth. Global demand for silver jewellery is forecast to rise by 4% in 2024, mainly due to higher sales and restocking in India. Jewellery offtake in India in 2023 was the second highest on record at 83.7 million ounces, buoyed by an improving economic performance. Additionally, consumption and restocking of silver jewellery are expected to pick up in the West, with European demand projected to rise by 2% in 2024, driven by growth in Italian exports.

Split of Silver’s demand between Industrial Fabrication and Physical Usage

Silver Supply Remains Flat

While silver demand has witnessed healthy growth over the past three years, its supply has remained flat for almost a decade. Global silver mine production has been declining steadily, adversely impacted by lower ore grades, mine closures in Argentina, Australia, and Russia, and a drop in output from gold mines due to strike action by workers in Mexico. Increased recycling of industrial, jewellery, and coin scrap has managed to restore some supply.

Structural Deficit in Silver

Since 2021, silver demand has consistently outpaced supply, creating a structural deficit. This imbalance is driven by increasing demand, particularly for use in photovoltaic cells. In 2023, this resulted in a deficit of 184.3 million ounces, which is projected to widen to 215.3 million ounces in 2024. The deficit over the past several years has caused above-ground silver stocks to reduce at a faster rate. Global silver inventories, which include silver stored in London Bullion Market Association (LBMA) custodian vaults and with futures exchanges like COMEX, Shanghai Gold Exchange, Shanghai Futures Exchange, and MCX,

have decreased by almost 35% from a peak of around 1,800 million ounces in 2021 to about 1,200 million ounces by Q1 2024.

The growing application of silver in emerging technologies and ongoing supply shortages are likely to persist for the foreseeable future. The green energy transition, along with increased investments in the electrical sector, could be a source of incremental silver demand going forward. In 2023, PV adoption

globally grew much faster than expected, led by China, where newly added installations hit a record of 216 GW, up over 140% year-on-year. The prospects for photovoltaics in 2024 also remain bright, with capacity additions forecast in the range of 550-600 GW. Silver demand will benefit from the increased

need for components used in power distribution and transmission systems, especially with the growth in energy offtake from data centres hosting Artificial Intelligence (AI) facilities.

Outlook for Silver

The supply-demand imbalance is expected to persist, indicating a favourable outlook for silver prices. Investors and stakeholders in the silver market should remain attentive to these dynamics as ongoing green energy initiatives, technological advancements, and sustained demand for jewellery fabrication will

likely drive silver demand in the medium to long term.

With these factors in mind, the silver market is poised for continued strength. As the world transitions to a greener future, silver’s role in enabling this shift cannot be overstated. Investors, policymakers, and industry participants should focus on harnessing the potential of this precious metal to drive sustainable growth and innovation in the years ahead.

Disclaimer: An investment with Alpha Alternatives (including its subsidiaries) is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in any such investment. This document is not intended to be comprehensive or to provide specific investment advice or services. The document is not in any form a substitute for such professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may affect you or your business. Before deciding to invest, prospective investors should read the definitive offering and subscription documents and pay particular attention to the risk factors contained therein. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant people and will be engaged only with relevant people. Any decision or action taken by you based on the information contained herein is your responsibility, and Alpha Alternatives is not liable in any manner for the consequences of such a decision or action. In deciding whether to make an investment with Alpha Alternatives, you must rely on your own evaluation of the terms of the proposed investment and the merits and risks involved, and, if applicable, upon receipt and careful review of any confidential memorandum, prospectus, or similar documents, and you should consult your legal, tax, investment, or other advisor. The contents of this document do not constitute and should not be construed as legal, tax, or investment advice. Although Alpha Alternatives has used all reasonable efforts to ensure that the information provided in this document is correct, Alpha Alternatives and its members, partners, stockholders, managers, directors, officers, employees, advisers, representatives, and agents make no representation and give no warranty that such information is accurate, complete or current, and you should not rely on the information provided in this document for any purpose.