Systematic Equity

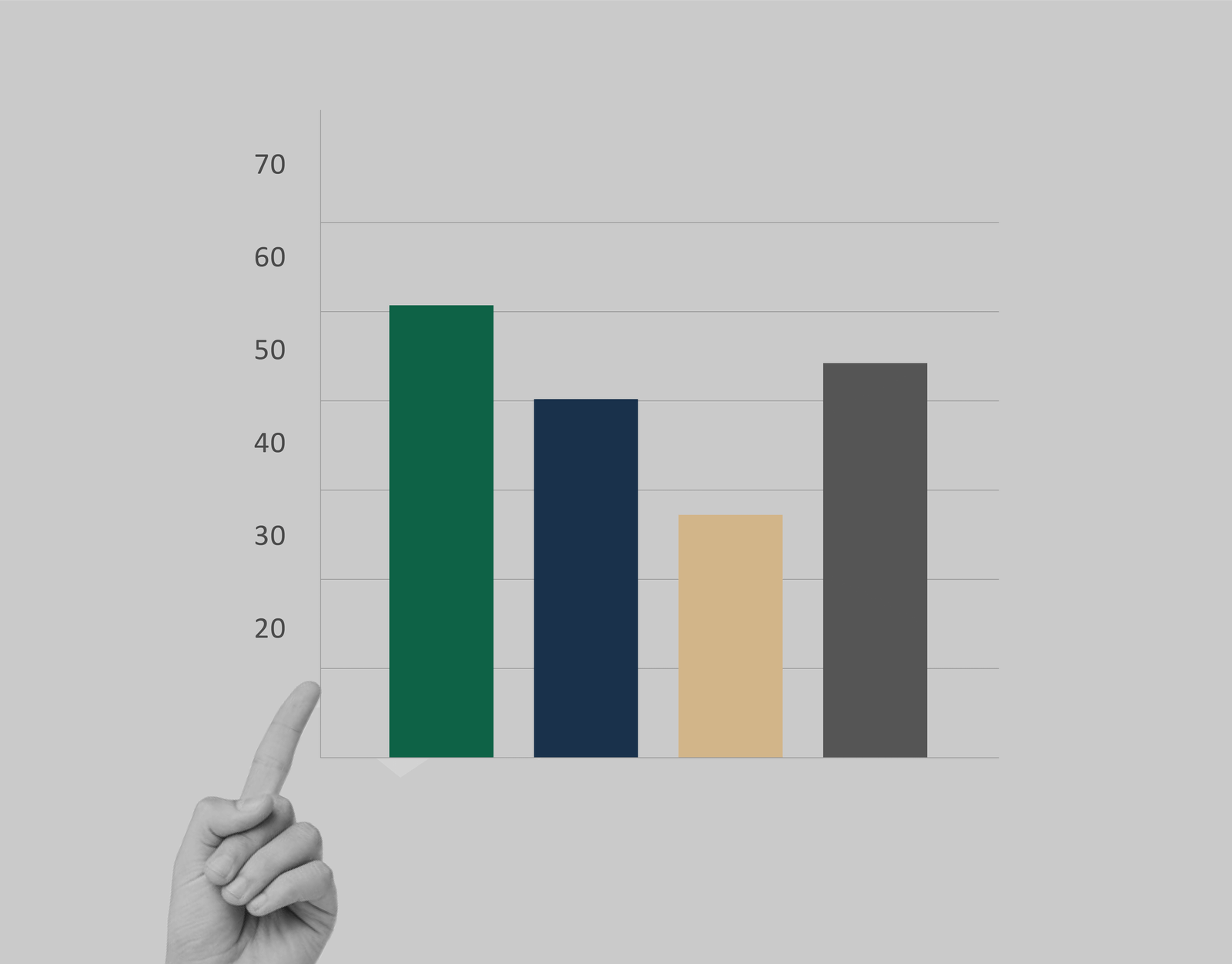

Systematic Equity is a long-only equity strategy driven by a multi-factor model combining Quality, Value, and Momentum within the NIFTY 100-500, eliminating manager bias. With an 11-year track record of outperforming the benchmark, it is offered as a DPMS for Indian investors.

Product

Systematic Equity

Fit in Portfolio

Long Equity

Liquidity

![]() High

High

Underlying assets

Equities

Structure

Discretionary PMS

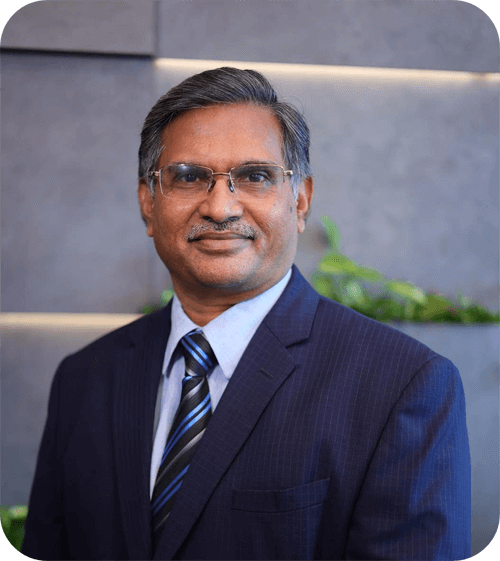

Navin Ganesh P

INVESTMENT TEAM

Navin brings over 12 years of experience in public markets, specialising in Systematic Equity, Multi-Factor Investing, and Tactical Asset Allocation. His work spans the full lifecycle of quantitative strategy development. His expertise spans the full spectrum of quantitative portfolio management from factor research and alpha-signal engineering to live strategy deployment, performance attribution, and risk management.

He has designed and managed investment strategies for large Family Offices, Corporate Treasuries, and Institutional Investors. He played a key role in building the Data Analytics function at Edelweiss Private Wealth to identify behavioural signals, estimate product flows and advisor benchmarking.

Previously, Navin also worked with the Shriram Group, where he managed INR 7 billion of Shriram Life Insurance’s equity AUM using factor-based and model-driven frameworks.

Navin holds a Master of Business Administration from the SP Jain Global School of Business (Dean’s List) and a bachelor’s degree in Electronics & Communication Engineering from SSN College of Engineering, Anna University. In his free time he builds Ai Agents to automate his tasks or play poker.