Silver’s Quiet Rally Won’t Stay Quiet for Long

Mudit Singhania , Partner & Head – Commodities

Thursday 19 June 2025

Silver has delivered strong returns, rising over 21% in 2024 and gaining an additional 18% so far in 2025. Although it has underperformed gold’s 27% YTD rally—a rare occurrence given silver’s usual outperformance in bull cycles—this divergence signals a potential opportunity. A deepening structural deficit, driven by strong industrial demand from electrification trends and constrained supply, is setting the stage for a significant rally. Given these fundamentals, we project silver prices to rise to $50 per troy ounce, implying a potential upside of around 42% over the next 24 months.

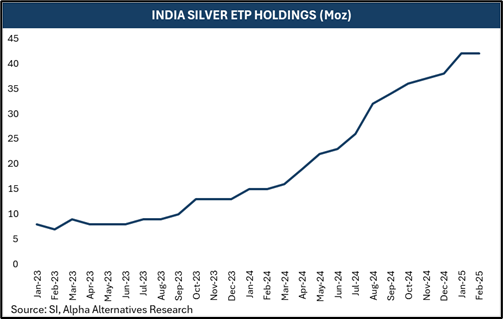

Rising Demand for Silver ETPs, Led by India

Silver Exchange-Traded Products (ETPs) experienced a notable surge in demand globally last year, with India emerging as a key growth driver despite being a relatively late entrant. In 2024 alone, Indian silver ETP holdings rose sharply by 25 million ounces (Moz), reaching a record high of 38.6 Moz.

The rising interest in silver is largely driven by expectations of strong price gains, drawing both retail and institutional investors. With growing interest in portfolio diversification and commodity-based assets, silver is expected to play a key role in meeting investment demands, particularly in emerging markets like India.

Speculative Flows Key to Sustaining Silver’s Upswing

Institutional investor activity has been a key force behind silver’s price movements, with a noticeable shift in sentiment in 2024. After a period of broad disengagement in 2022–2023, institutional interest turned decisively positive, helping to drive the strong price rally seen last year.

The money managers’ positions on the COMEX, which had briefly shifted to being net short in the first quarter of 2024 have steadily rebuilt their long exposure. During the next three quarters, money managers averaged a net long position of ~33,000 contracts — a 230% surge — signalling a strong rebound in bullish sentiment toward silver. Looking ahead, the convergence of record-high gold prices, an unusually high gold-to-silver ratio, and an ongoing supply deficit driven by growing industrial demand could continue to increase professional investors’ interest in silver.

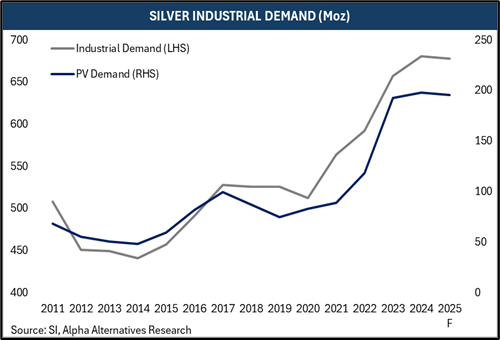

Electrification and Next-Gen Solar to Power the Surge in Silver Industrial Demand

Silver’s industrial role is strengthening amid the global push toward electrification and adaptation of advanced technologies. In 2024, industrial demand climbed 4% YoY to a record 680.5 Moz, making up nearly 59% of total silver consumption. This marked four straight years of growth.

Silver demand is rising fast due to the solar industry. In 2016, solar panels used just 8% of global silver, but that more than doubled by 2024. Advanced Solar Cell technologies like TOPCon, which use about 30% more silver than older panels, are gaining ground and could dominate the market by 2030. Even more advanced technologies like HJT (Heterojunction Technology) could push silver demand even higher, using over twice as much silver as today’s panels.

Silver demand from electric vehicles is rising quickly, as battery electric vehicles use nearly twice as much silver as traditional internal combustion engine (ICE) cars. This is mainly due to their greater dependence on electronics, battery systems, and charging components. In 2024, EVs made up about 18% of new vehicle sales globally, and this share is projected to reach 50% by 2030, according to McKinsey. With the global EV fleet expected to grow by around 200 million vehicles between 2025 and 2030, this could drive additional cumulative silver demand of roughly 250 million ounces from the EV sector alone, significantly contributing to the persistent structural deficit.

Meanwhile, the demand for electronics is expected to rise at a CAGR of 8% over the next five years as AI, 5G, and next-gen computing go mainstream. Altogether, industrial use—anchored in energy, mobility, and connectivity—will remain the fastest-growing driver of long-term silver demand.

Silver Mining Faces Structural Headwinds

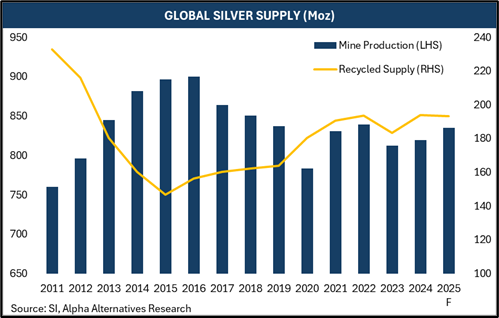

Global silver supply has been on a structural decline since mine production peaked at 900 Moz in 2016, dropping to 820 Moz by 2024. Although annual output shows some fluctuations, the long-term trend is downward, driven by the depletion of high-grade deposits, delays in obtaining mining permits, and limited investment in new primary silver projects.

Primary silver production has steadily decreased, with its share of total supply shrinking from 32% in 2016 to less than 28% in 2024. As a result, miners increasingly rely on silver produced as a by-product from lead, zinc, copper, and gold operations. Lead and zinc mines remain the largest contributors to global silver output, making upto 30% of the total supply. China, which dominates global production of lead and zinc, has seen its silver output fall by 10% to 110 Moz between 2016 to 2024. This decline reflects reduced production from lead and zinc operations, driven by reserve exhaustion, tighter environmental policies, and broader economic pressures. While recycled silver has offered some support to supply, it has not been sufficient to offset the ongoing decline in mine production.

Tightening Inventories Signal Long-Term Bullish Outlook

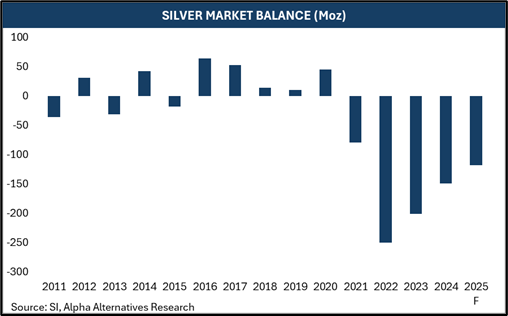

Silver recorded its fourth straight annual supply deficit in 2024, with a shortfall of 149 Moz, despite a modest 2% rise in supply. Another deficit of 118 Moz is projected for 2025, pushing the cumulative shortfall from 2021-2025 to nearly 800 Moz—roughly equivalent to a full year of global mine output. However, these persistent deficits are steadily depleting available stockpiles which could prompt prices to rise at a faster pace. By April 2025, inventories held in London vaults and global exchanges had fallen by 305 Moz (~20%) from 2020 levels. Visible inventories across COMEX, SHFE, and LBMA now stand at about 1,267 Moz, equivalent to just one year of global demand.

The underlying stock buffer in the silver market has been steadily diminishing over the last 4 years. Ongoing structural demand from sectors like solar PV, electric vehicles, grid modernization, and broader electrification continues to strengthen, while renewed investor interest—evident from rising inflows into silver ETPs— will continue to add to the bullish outlook. We anticipate tightening inventories will create a solid base for sustained upside in silver prices over the next few years. Any tariff-induced pullbacks should be viewed as strategic entry points for long-term investors to build exposure to the precious metal ahead of the next major leg higher.

Disclaimer: An investment with Alpha Alternatives (including its subsidiaries) is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in any such investment. This document is not intended to be comprehensive or to provide specific investment advice or services. The document is not in any form a substitute for such professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may affect you or your business. Before deciding to invest, prospective investors should read the definitive offering and subscription documents and pay particular attention to the risk factors contained therein. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant people and will be engaged only with relevant people. Any decision or action taken by you based on the information contained herein is your responsibility, and Alpha Alternatives is not liable in any manner for the consequences of such a decision or action. In deciding whether to make an investment with Alpha Alternatives, you must rely on your own evaluation of the terms of the proposed investment and the merits and risks involved, and, if applicable, upon receipt and careful review of any confidential memorandum, prospectus, or similar documents, and you should consult your legal, tax, investment, or other advisor. The contents of this document do not constitute and should not be construed as legal, tax, or investment advice. Although Alpha Alternatives has used all reasonable efforts to ensure that the information provided in this document is correct, Alpha Alternatives and its members, partners, stockholders, managers, directors, officers, employees, advisers, representatives, and agents make no representation and give no warranty that such information is accurate, complete or current, and you should not rely on the information provided in this document for any purpose.