Structured Credit Opportunities Fund

Private credit investments with equity upside and robust downside protection. High-yield opportunities include special situations funding, debt restructuring, and operating equity, with a strong focus on risk management through strict controls on leverage, collateral, and servicing. Offered as a 5-year Category II AIF, the Structured Credit Opportunities Fund is currently open for subscription.

Product

SCOF

Fit in Portfolio

Private Credit

Liquidity

![]() Low

Low

Underlying assets

Private Credit

Structure

CAT II AIF

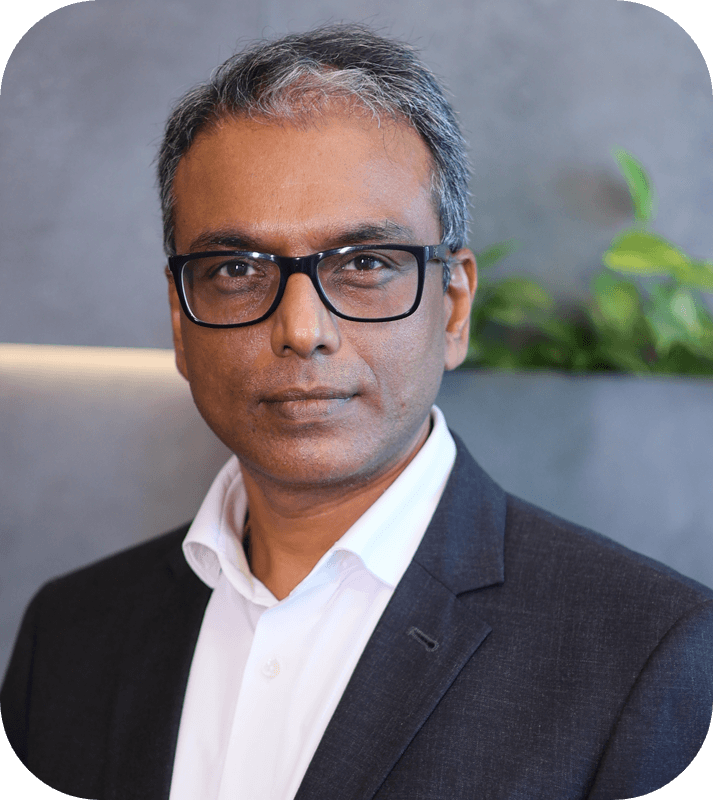

Kaushal Biyani

FUND MANAGER

Kaushal heads the Illiquid Alternatives Group at Alpha. He is the fund manager for the Structured Credit and the Build India Infrastructure funds. He also oversees structuring elements across the firm.

He began his career with Ernst & Young’s M&A team before joining the Essar Group, where he played a pivotal role in structuring complex deals and managing high-stakes negotiations. Notably, he led one of India’s largest FDI transactions and the execution of one of the country’s largest corporate delistings.

Beyond his professional endeavors, Kaushal is a faculty member of the Art of Living Foundation, conducting meditation programs for corporate professionals, youth and rural parts of India.

Kaushal is a Bachelor of Commerce from the University of Mumbai and a Chartered Accountant (AIR 22).