Beyond the Hedge: Gold’s Rise as the World’s Neutral Reserve Asset

Thursday 06 November 2025

By Mudit Singhania

Gold has had a remarkable year in 2025, appreciating by over 50% in US dollar terms and nearly 60% in Indian rupees, aided in part by currency depreciation. Spot prices reached a record high of $4,381/oz in October, exceeding our earlier projection of $3,900/oz by Q1 2027 outlined in the gold outlook released in March 2025.

In our March 2025 outlook, we highlighted that rising fiscal imbalances, growing public debt, and a turn in the global interest rate cycle could lead investors and central banks to increase allocations to assets such as gold. Much of that thesis appears to have materialized, though the pace and scale of the rally have exceeded most forecasts.

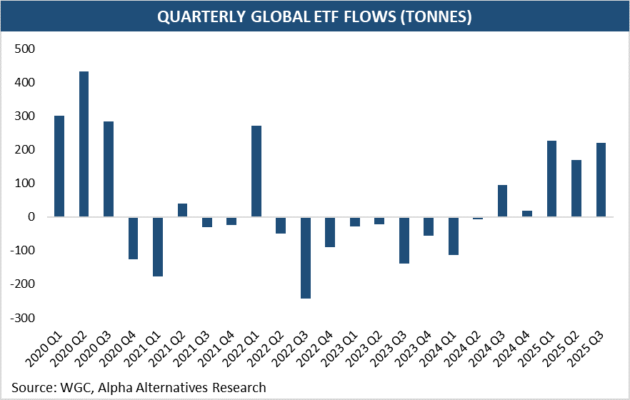

Over recent months, buying has remained robust, ETF inflows have accelerated, and the shift in monetary policy has drawn renewed attention to real rates and their long-term implications. Meanwhile, broader macro and geopolitical uncertainties have reinforced gold’s standing as a preferred store of value.

Although some near-term moderation is possible if progress is made on global diplomatic fronts—such as the Russia–Ukraine peace process or an easing in trade tensions between the US and China—the fundamental backdrop supporting gold remains largely intact.

We continue to hold a long-term bullish outlook on gold, viewing any significant pullback as a buying opportunity. Supported by both structural and cyclical drivers detailed below, we expect prices to advance toward $5,500/oz by mid-2027.

Structural Backdrop: Debt, Debasement and Diversification

The deterioration in public finances across major economies has become a defining feature of the current macro landscape. US federal debt now exceeds 122% of GDP, with annual interest payments crossing $1 trillion, surpassing defense spending for the first time. The IMF projects US debt to reach 143% of GDP by 2035, underscoring how sustained deficits and rising borrowing costs are reshaping long-term debt dynamics.

These trends have prompted markets to reassess the long-term stability of fiat currencies. As debt growth outpaces nominal GDP and fiscal consolidation remains politically difficult, investors increasingly perceive a gradual erosion in the purchasing power of paper currencies. This has contributed to the ‘debasement trade’ i.e. a broader shift toward hard assets like gold—not as a reactionary trade, but as a strategic hedge against policy drift and inflation tolerance.

The phenomenon is not confined to the United States. Across advanced economies, long-term yields have risen, often outpacing those in emerging markets. Political gridlock and aging demographics are compounding fiscal pressure, while commitments to defense and welfare spending leave limited room for retrenchment. Germany and Japan—historically viewed as fiscal anchors—now face similar constraints. As a result, the search for politically neutral stores of value has become a more universal theme.

In this context, gold has re-emerged not merely as a hedge against inflation, but as a form of portfolio discipline—a way for investors and central banks to preserve value amid persistent fiscal uncertainty.

Shifting Global Reserves: A Gradual Realignment

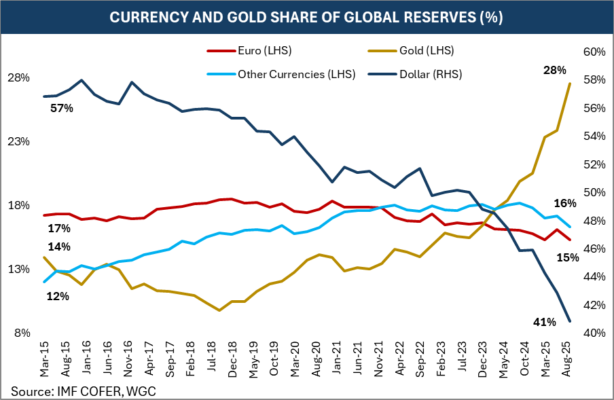

One of the most notable developments in recent years has been the reallocation of global reserves. Central banks have expanded their gold holdings at a historic pace, purchasing over 1,000 tonnes annually for three consecutive years. As of 2025, gold accounts for nearly 28% of total central bank reserves, compared with about 12% a decade ago.

This diversification trend reflects a combination of strategic and risk-management motives. Gold offers liquidity without counterparty risk, an attribute increasingly valued amid the growing use of financial sanctions and broader geopolitical fragmentation.

China continues to lead official-sector accumulation, with the People’s Bank of China now holding approximately $283 billion in gold, or 7.7% of its total reserves, after consistent annual purchases exceeding 500 tonnes since 2022. Other countries—including Poland, Turkey, India, and Kazakhstan—have also been steady buyers, suggesting a broad-based move toward reserve diversification rather than an isolated policy shift.

As of Q3 2025, global central banks had collectively purchased over 630 tonnes, keeping the year on track to match 2022’s record pace. This accumulation has gradually altered the composition of global reserves: the US dollar’s share has declined to around 41%, from 53% five years ago, while the value of official gold holdings has, for the first time, exceeded the combined value of US Treasuries held by central banks.

Gold, once seen primarily as an insurance asset, has now become a mainstream reserve component—a quiet but steady structural realignment that signals an evolving balance in the global monetary system.

Cyclical Drivers: The Policy Pivot and Portfolio Hedging

The Federal Reserve’s policy shift in 2025 has added a cyclical layer to gold’s structural strength. Softer labour data and steady inflation prompted a turn toward monetary easing, pushing real yields lower and rekindling investor interest in precious metals.

Gold-backed ETFs, which had seen years of subdued activity, have experienced a resurgence, with year-to-date inflows exceeding 620 tonnes—the second-highest annual tally after 2020. This renewed participation highlights how policy recalibration can quickly reawaken latent investment demand.

Portfolio diversification trends are also contributing to this momentum. Institutional investors have modestly increased gold allocations as a hedge against stretched equity valuations, particularly in sectors benefiting from the AI-driven technology boom. In China, household and institutional interest in gold continues to rise as real estate—a traditional store of value—faces structural headwinds.

The convergence of these cyclical and structural factors has lent depth to this rally, reinforcing the notion that gold’s ascent is driven by more than short-term sentiment.

Consolidation and Continuity: The Road Ahead for Gold

Gold’s role in the global financial ecosystem continues to evolve. Once viewed narrowly as a hedge against inflation or crisis, it is now increasingly regarded as a counterbalance to financial system leverage and sovereign risk. Its appeal lies not in yield or growth, but in the absence of liability—a characteristic that few other assets share.

While the recent rally has been striking, the drivers behind it appear less speculative and more grounded in enduring macroeconomic shifts. The combination of high public debt, softening real yields, and persistent reserve diversification suggests that the bid for safety remains a defining feature of the current market cycle.

That said, a period of consolidation or range-bound trading would not be unusual following such a sharp appreciation. The balance between easing monetary conditions and episodic bouts of risk appetite may shape short-term moves. Yet, the longer-term narrative—of gold as an anchor in an increasingly uncertain monetary and fiscal landscape—remains visible beneath the ebb and flow of market sentiment.

Disclaimer: An investment with Alpha Alternatives (including its subsidiaries) is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in any such investment. This document is not intended to be comprehensive or to provide specific investment advice or services. The document is not in any form a substitute for such professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may affect you or your business. Before deciding to invest, prospective investors should read the definitive offering and subscription documents and pay particular attention to the risk factors contained therein. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant people and will be engaged only with relevant people. Any decision or action taken by you based on the information contained herein is your responsibility, and Alpha Alternatives is not liable in any manner for the consequences of such a decision or action. In deciding whether to make an investment with Alpha Alternatives, you must rely on your own evaluation of the terms of the proposed investment and the merits and risks involved, and, if applicable, upon receipt and careful review of any confidential memorandum, prospectus, or similar documents, and you should consult your legal, tax, investment, or other advisor. The contents of this document do not constitute and should not be construed as legal, tax, or investment advice. Although Alpha Alternatives has used all reasonable efforts to ensure that the information provided in this document is correct, Alpha Alternatives and its members, partners, stockholders, managers, directors, officers, employees, advisers, representatives, and agents make no representation and give no warranty that such information is accurate, complete or current, and you should not rely on the information provided in this document for any purpose.