Equity Mutual Fund Inflows Reach All-Time High Rs.42,702 Crore in July, Rise 81%: AMFI

India’s mutual fund sector experienced a record surge in investor appetite during July 2025, with equity mutual fund inflows shooting up 81% from the previous month to Rs.42,702 crore (US$ 4.87 billion), said the Association of Mutual Funds in India (AMFI) latest figures. This is the largest-ever monthly intake for equity funds and the 53rd straight month of positive inflows into equity funds.

Historic Month for the Mutual Fund Industry

The assets under management (AUM) of the industry also reached its all-time high of Rs.75.36 lakh crore, led by high investor participation in both the equity and debt segments. Importantly, Systematic Investment Plans (SIPs) continued to drive retail participation, with record SIP inflows of Rs.28,464 crore in July, as the total active SIP accounts reached 9.11 crore.

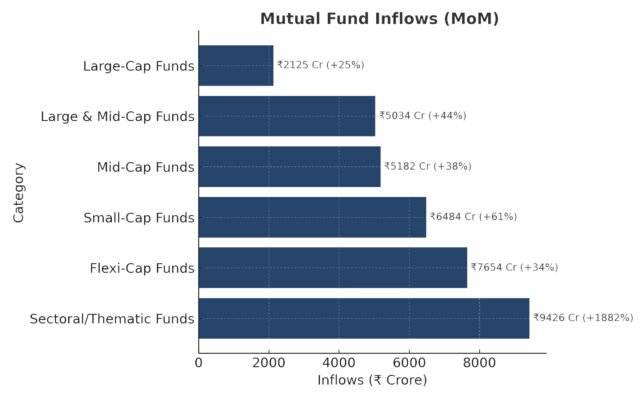

Category-Wise Equity Fund Performance

Investor demand was robust across all 11 categories of equity funds monitored by AMFI, with many recording their highest-ever inflows:

Thematic strategies picked up unprecedented momentum, a sign of investor confidence in focus-growth industries despite market turbulence overall.

Debt Funds Make a Return

Debt mutual funds also saw a stunning reversal, with net inflows of Rs.1.06 lakh crore in July. Liquid funds and money market funds were the top performers, riding high on advantageous short-term yield prospects as well as corporate treasury investment.

Domestic Investors Offset FPI Outflows

Interestingly enough, the upsurge in domestic investment occurred when foreign portfolio investors (FPIs) were net sellers, pulling out close to $2 billion from Indian equities as global trade uncertainty and lackluster earnings guidance prompted caution. Retail and domestic institutional investors are believed to have seen this as a buying opportunity, reinforcing the strength of the market.

Outlook: Positive Sentiment Likely to Continue

Market analysts feel the strong inflows indicate high retail confidence in equities and the continued popularity of SIPs as a disciplined wealth creation tool. With sector-specific opportunities, strengthening macroeconomic indicators, and accommodative monetary policy, the pace in mutual fund inflows is likely to continue in the next few months.

CONCLUSION

July 2025 will be a historic month for India’s mutual fund sector—both for the record-breaking equity flows and the ongoing dominance of retail-led SIP investments. The figures are an indication of a maturing investment culture when domestic participation is increasingly counterbalancing global headwinds.

Disclaimer: An investment with Alpha Alternatives (including its subsidiaries) is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in any such investment. This document is not intended to be comprehensive or to provide specific investment advice or services. The document is not in any form a substitute for such professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may affect you or your business. Before deciding to invest, prospective investors should read the definitive offering and subscription documents and pay particular attention to the risk factors contained therein. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant people and will be engaged only with relevant people. Any decision or action taken by you based on the information contained herein is your responsibility, and Alpha Alternatives is not liable in any manner for the consequences of such a decision or action. In deciding whether to make an investment with Alpha Alternatives, you must rely on your own evaluation of the terms of the proposed investment and the merits and risks involved, and, if applicable, upon receipt and careful review of any confidential memorandum, prospectus, or similar documents, and you should consult your legal, tax, investment, or other advisor. The contents of this document do not constitute and should not be construed as legal, tax, or investment advice. Although Alpha Alternatives has used all reasonable efforts to ensure that the information provided in this document is correct, Alpha Alternatives and its members, partners, stockholders, managers, directors, officers, employees, advisers, representatives, and agents make no representation and give no warranty that such information is accurate, complete or current, and you should not rely on the information provided in this document for any purpose.