Commodities: The Diversifier Every Portfolio Needs

Mudit Singhania , Partner & Head – Commodities

Tueday 02 September 2025

In an increasingly uncertain global investment landscape, the role of commodities as a portfolio diversifier has gained renewed relevance. From mitigating downside risks to providing exposure to real assets driven by fundamental supply-demand dynamics, commodities can improve a portfolio’s risk-adjusted returns. As investors across the world reevaluate traditional asset allocation strategies, India too is witnessing growing interest in this historically underutilised asset class.

Rethinking Diversification: Why Commodities Belong in Your Portfolio?

Diversification and Enhanced Risk-Adjusted Returns – Commodities have low or negative correlation with equities and bonds, helping reduce portfolio volatility and cushioning against market drawdowns—particularly during equity stress. This diversification improves overall portfolio Sharpe ratios.

Crisis Protection Through Real Assets – As physical assets with intrinsic value, commodities provide portfolio protection during periods of market turmoil and geopolitical uncertainty, maintaining value when financial assets decline.

‘Crisis Alpha’ in Geopolitical Shocks – Gold, oil, and other commodities often surge during geopolitical tensions, conflicts, or supply disruptions, providing what’s known as “crisis alpha” — returns produced by specific assets amid market turmoil — thereby enhancing a portfolio’s resilience during periods of instability.

Alpha from Cyclical Inefficiencies – Commodity markets follow capital expenditure (capex), weather, and supply-demand cycles, creating structural inefficiencies that active managers and AIFs can exploit for uncorrelated alpha.

International Trends: Developed Markets Embrace Commodities

Institutional portfolios in developed markets typically allocate materially higher proportions to alternatives. Research indicates institutions have averaged about 25% in alternatives versus roughly 5% for advisors, underscoring the broader adoption outside India. This under-allocation positions India for a significant growth runway in alternatives – particularly in Commodities as regulations evolve and investor appetite deepens.

From Stability to Shock: Why Commodities Matter More Than Ever

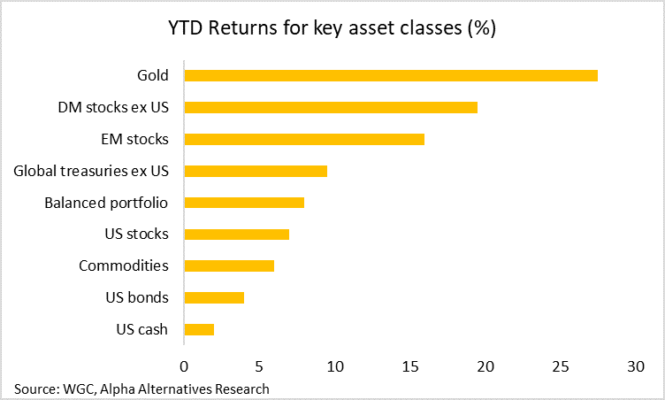

In the post-global financial crisis period, portfolios leaned heavily on US equities, supported by accommodative interest rates and overall market stability. Today’s environment, however, is defined by elevated uncertainty and increasing market volatility—calling for more robust portfolio construction. As traditional 60/40 stock-bond portfolios struggle amid stretched valuations and higher yields, investors are increasingly shifting toward alternatives like commodities, hedge funds, and macro strategies to boost diversification and manage downside risk.

At the same time, growing policy uncertainty and political risk make real, non-financial assets like commodities increasingly appealing. A structurally weaker dollar—undermined by soaring debt and fiscal concerns—alongside global moves to reduce dollar reliance, further supports demand for dollar-denominated commodities such as Gold and Oil. Heightened geopolitical tensions, trade disruptions, and growing risks of broader conflicts only amplify the appeal of crisis-responsive assets. Meanwhile, record gold purchases by central banks—including the PBOC and RBI—signal a strategic shift toward assets that offer portfolio diversification, currency exposure, and geopolitical resilience.

Evolving Indian Landscape Favors Commodities

India’s commodity market has undergone a structural transformation over the past decade, driven by progressive reforms from SEBI and deepening market infrastructure. What was once a domain for hedgers and traders is now rapidly institutionalizing, opening up new opportunities for investors seeking diversification, real asset exposure, and access to supply-demand driven fundamentals.

Key Drivers of India’s Commodity Market Evolution:

Unified Regulatory Oversight Under SEBI – The shift of commodities under SEBI’s purview in 2015 created a consistent regulatory framework across equities, derivatives, and commodities—enhancing transparency, compliance, and governance across exchanges.

Wider Institutional Participation in Commodities – SEBI’s decision to permit AIFs in 2017, followed by Mutual Funds and PMS in 2019, to participate in commodity derivatives, has meaningfully broadened market access. Institutional participation is helping move commodities from a speculative trade to a strategic asset class.

Strengthening Precious Metals Access via ETFs – SEBI has enhanced investor access to precious metals by revamping gold ETF regulations in 2021 and introducing Silver ETFs in 2022—allowing broader retail and institutional participation in these precious metals through regulated, efficient vehicles.

Enhanced Risk Management Tools – Launch of options on futures, index options, and cross-margining benefits have improved capital efficiency and flexibility, making commodities more accessible for both hedgers and investors.

MCX Liquidity Hits New Highs Amid Institutional Inflows – MCX – India’s premier commodities exchange – average daily turnover (ADTO) rose substantially in Q1 FY2026, reaching ~3 lakh crore, driven by rising institutional activity and broader market participation—making MCX a deeper and more efficient platform for commodity trading.

CONCLUSION:

Time to Rebalance

Among alternative assets, commodities—and gold in particular—offer a compelling blend of liquidity, diversification, and crisis resilience that is increasingly relevant in today’s volatile environment. Empirical evidence suggests that allocations to gold in the low- to mid-single digits have historically helped reduce portfolio drawdowns and improve diversification enhancing risk-adjusted returns. As portfolios around the globe and in India evolve toward more resilient allocation structures, commodities are poised to transition from tactical hedges to strategic anchors.

Disclaimer: An investment with Alpha Alternatives (including its subsidiaries) is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in any such investment. This document is not intended to be comprehensive or to provide specific investment advice or services. The document is not in any form a substitute for such professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may affect you or your business. Before deciding to invest, prospective investors should read the definitive offering and subscription documents and pay particular attention to the risk factors contained therein. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant people and will be engaged only with relevant people. Any decision or action taken by you based on the information contained herein is your responsibility, and Alpha Alternatives is not liable in any manner for the consequences of such a decision or action. In deciding whether to make an investment with Alpha Alternatives, you must rely on your own evaluation of the terms of the proposed investment and the merits and risks involved, and, if applicable, upon receipt and careful review of any confidential memorandum, prospectus, or similar documents, and you should consult your legal, tax, investment, or other advisor. The contents of this document do not constitute and should not be construed as legal, tax, or investment advice. Although Alpha Alternatives has used all reasonable efforts to ensure that the information provided in this document is correct, Alpha Alternatives and its members, partners, stockholders, managers, directors, officers, employees, advisers, representatives, and agents make no representation and give no warranty that such information is accurate, complete or current, and you should not rely on the information provided in this document for any purpose.