Quality Investing for long-term growth with lower volatility

Authored by Vineet Sachdeva, Entrepreneur Partner-Quantitative Equity Investing, Alpha Alternatives

Monday May 2024

Investing through quality factor focuses on identifying companies that exhibit certain characteristics, such as strong financial health, sustainable competitive advantages, and consistent earnings growth. Quality and Value have been the oldest and most pervasive factors in the field of investing. Quality factor has historically worked very well in the Indian stock market due to the country’s unique economic conditions and market structure. Here’s why quality as a factor tends to deliver reasonable returns:

- Resilience in volatility/ downside protection: India’s stock market, often experiences higher volatility compared to developed markets. Quality companies, with strong balance sheets tend to outperform during periods of volatility e.g. during the covid period in Q1 of 2020, sectors such as Healthcare, IT and FMCG, known for quality companies handsomely outperformed the market and the alpha in the 3-month period ranged from 5-20%. The volatility of these sectors was also much lower than that of the market.

- Long-term growth consistent growth over speculation: Quality stocks, with strong fundamentals, provide stability and consistently compounding returns over the long term. During speculative stages in the market, different sectors attract market attention for their “potential”– however only a handful of companies in the sector can deliver this “promise”, making investors go back to quality e.g. Infrastructure in 2007, PSUs in 2014, NBFCs in 2018 were all followed by prolonged periods of heartburn. Quality companies almost always delivered reasonable returns after these irrationally exuberant phases.

- Sustainability, leadership and valuation premium: Many quality companies in India operate in sectors with high barriers to entry, such as FMCG, IT, Healthcare or banking. These companies often enjoy a dominant market position, leading to sustained profitability and delivering reasonable returns over long period of time. They also command premium valuations to the market. However quality investing comes with its risks that investors should be consider before investing.

- Valuation risk: Quality stocks often trade at premium valuations because of their strong fundamentals, profitability, and resilience. However, paying too high a price can reduce future return potential, especially if growth expectations are not met e.g. private banks which were trading at lofty valuations a few years back have had a rough time for the last couple of years.

- Underperformance in momentum-driven markets: During bull market periods, momentum investing, in which speculative, lower-quality stocks (especially in cyclical sectors like real estate, infrastructure, or small caps) may outperform in short bursts. In such phases, quality stocks might lag in price performance because of their conservative growth outlook and valuation discipline.

- Sectoral Concentration: Quality as a factor often leads investors towards sectors, such as FMCG, IT, Healthcare and Banking, where companies are more likely to display high profitability, low debt, and strong balance sheets. This concentration exposes investors to sector-specific risks, such as regulatory changes, currency fluctuations (IT and Healthcare), or macroeconomic trends that could affect demand (FMCG and banking).

- Overemphasis on stability at the cost of growth: Quality companies are often mature businesses with stable earnings, but they may not offer the same growth potential as smaller, more aggressive companies. This focus on stability can result in relatively modest returns during growth phases of the economy. Also, since quality looks at historical metrics, past performance, may not be replicable in the future.

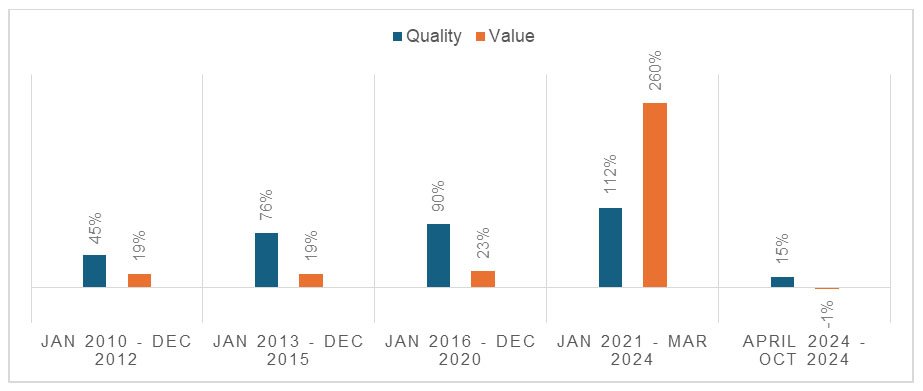

In the Indian markets, Quality as a factor has outperformed over longer periods of time as can be seen from the table below. In the last 3 years, Value has outperformed because of the run up of all kinds of businesses and investors mostly ignoring Quality. However, we see this anomaly correcting again as investors become cognizant of frothy valuations and look at genuine businesses with long term history of performance. Let’s understand it in detail from the following data: –

(Source: Bloomberg, Alpha Alternatives Research)

Quality as a factor, expresses itself over a long period of time and if approached with the right framework (avoiding questionable credentials, being mindful of growth prospects, not paying a high price, sector rotation within Quality), can be a source of long-term alpha with much lower volatility than the market.

Disclaimer: An investment with Alpha Alternatives (including its subsidiaries) is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in any such investment. This document is not intended to be comprehensive or to provide specific investment advice or services. The document is not in any form a substitute for such professional advice or services, and it should not be acted on or relied upon or used as a basis for any decision or action that may affect you or your business. Before deciding to invest, prospective investors should read the definitive offering and subscription documents and pay particular attention to the risk factors contained therein. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant people and will be engaged only with relevant people. Any decision or action taken by you based on the information contained herein is your responsibility, and Alpha Alternatives is not liable in any manner for the consequences of such a decision or action. In deciding whether to make an investment with Alpha Alternatives, you must rely on your own evaluation of the terms of the proposed investment and the merits and risks involved, and, if applicable, upon receipt and careful review of any confidential memorandum, prospectus, or similar documents, and you should consult your legal, tax, investment, or other advisor. The contents of this document do not constitute and should not be construed as legal, tax, or investment advice. Although Alpha Alternatives has used all reasonable efforts to ensure that the information provided in this document is correct, Alpha Alternatives and its members, partners, stockholders, managers, directors, officers, employees, advisers, representatives, and agents make no representation and give no warranty that such information is accurate, complete or current, and you should not rely on the information provided in this document for any purpose.